Pensions Dashboards

Making light work of pensions dashboards

Members are at the heart of everything a pension scheme does. Pensions Dashboards are set to give your members the information they need to plan their retirement.

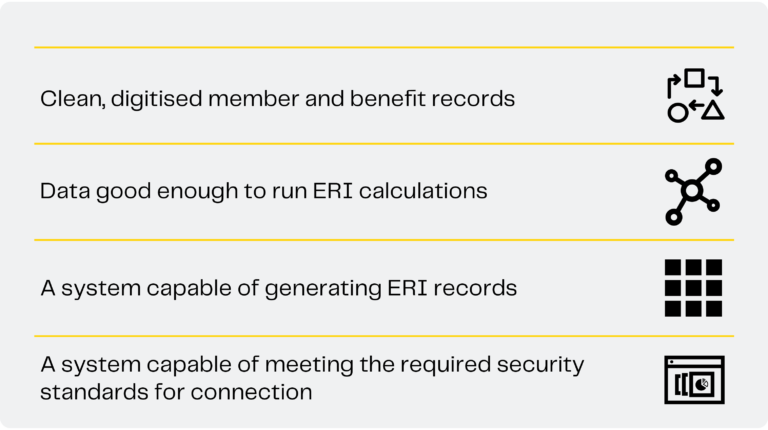

To be part of the solution you need your member data to be digital, accurate and ready to be sent to the dashboard ecosystem.

The deadline for dashboard connection may be October 2026 but 72% of 93 consultants recently surveyed reported a significant slowdown in activity.

Mantle users are ‘Dashboard ready’ now. Are you?

Data cleansing and digitising

For a member to find their pension information they must be accurately identified. The biggest fear is how to make data that is disjointed and ungainly translate to a digital platform. The task is not only gathering the data but also ensuring it is as complete as possible.

Here at Mantle, we believe that if you look after your data, the data will look after you. That is why Mantle is built on checking your data, filling it up and using it to its fullest potential with 100% automation.

Transitioning to Mantle includes a data check process where all member, scheme and benefit data is gathered, sorted and analysed. You can then see where the gaps are and take control to fill those gaps and make sure everything you hold is correct.

Once any data shortcomings are addressed, they are resolved permanently, Mantle will provide full transparency over the ongoing quality and management of the data. Data held in Mantle meets the Data Standards of the Pensions Dashboards Programme. Once connected to the Pensions Dashboard infrastructure the pensions provider will be ready to receive a ‘Find message’. A ‘Find message’ seeks to identify if the customer has benefits with a scheme using personal details which the receiving scheme needs to interrogate for a match across its membership.

Find data includes:

- Name, address,

- Date of Birth (DOB),

- National insurance number,

- Email and,

- Mobile number.

When a match is made, ‘view’ data is sent from the provider to the dashboard about the member’s pension. Where scheme data is insufficient it will not match with the ‘Find’ data sent from the member. This will mean that a record of their participation in the scheme will not be sent to them.

Generating and returning Estimated Retirement Income to the dashboard

The clean and digitised data will generate the ‘view’ data; detail on the pension arrangement, information of the organisation administering the pension and where available, the employment which gave rise to the pension arrangement.

Arguably the most important element of the find data is the Estimated Retirement Income (ERI) value. Once your data has been screened and cleaned the ERI calculations are coded in, calculated and stored ready for any requests. Your administrators shouldn’t be aware of the demand from members to the dashboard, unless there happens to be a data gap or error.

Should an ERI calculation fail, this is flagged, resolved by the administrator and a new ERI automatically calculated and returned.

If a pre-calculated value is used, the ERI figure can’t be more than 12 months old. Mantle will automatically recalculate the ERI on an annual basis.

As a Mantle user your Dashboard requirements are met from transition. You can get on and service your members as normal, safe in the knowledge your past and present members can access their pension information from you, to make informed decision about their financial futures.

Communicating with the dashboard ecosystem

There is no doubt that Pensions Dashboards are solving a long-standing problem of ensuring members have access to their pension information to make informed decisions for their retirement. There have been many initiatives trying to engage the public in understanding and using their pensions to their fullest potential.

This can only be achieved with the cooperation of the pensions industry, willing to translate data many decades old. There is also the question of whether current administrative resources are able to accommodate the requests and calculations needed for connection to be successful.

Pensions Dashboard Programme Standards

The Pensions Dashboard Programme have developed standards for several areas that dashboard providers, pension and scheme providers are expected to meet.

- Data standards set out the data formatting requirements pension providers must follow when returning pensions data.

- Technical standards are what data and dashboard providers will use to interface with the central technical architecture and/or each other.

- The code of connection will combine the required security, service and operational standards, which ecosystem participants must adhere to.

- Reporting standards will provide a description of the data that both pension providers and dashboard providers must supply to regulatory bodies, PDP and DWP, to monitor the effectiveness and health of the ecosystem.

With the power of Mantle your member data can be found, fixed and secured. Your administrators will not be overwhelmed when dashboards are launched, and members begin to take control of their retirement decisions.

Connection to the dashboards is simply a by-product of being a Mantle user and your administrators can continue spending their time servicing your members with care and compassion.

To find out more about Mantle, the transition process and how it helps you to meet Pensions Dashboards requirements contact us.

What's included

Digitised accessible member records

Integrated automated ERI calculations

Secure data hosting and Dashboards compliance via ALTUS ISP

Real time return of find

message

Incomplete data ERI workaround

No one off costs, data hosting included in licence fee

Let's talk about you

To discuss how we can help with your company pensions and challenges, please contact us.

For general enquires enquiries@mantleservices.com

Linen Loft

27-37 Adelaide Street

Belfast , BT2 8FE UK

+44 28 9041 2888