Pension Actuarial Valuation Software

A powerful way to model actuarial valuation software

Mantle Actuarial is a modern, cloud hosted software for pension actuarial valuations. It helps pension schemes and advisers understand the funding position, liabilities and much more.

Mantle can accommodate any calculation, no matter how complex, enabling a high degree of accuracy. Calculations can be run from benefit calculations or imported cashflows. It also features integrated Asset Liability modelling enabling portfolio optimisation.

Mantle for Actuarial

Empowering actuaries with secure and reliable pension valuation software.

Real-time Funding Insights

Instantly view a scheme’s financial position through live investment feeds.

Comprehensive Risk Management

Optimise investment strategies with detailed portfolio testing.

Seamless Data Integration

Automatically update actuarial calculations from live member data.

Robust Cloud Reliability

Powerful, scalable computing power.

20,000

Valuations runs monthly

>15,000

Engaged user hours on platform monthly

1.7m

In excess of 1.7m member records hosted

£1bn

Member payments administered annually

Our Customers

Features

Explore Mantle’s Actuarial Product Features.

Valuations

Mantle leverages live investment feeds to provide an up-to-date view of a scheme’s funding position at any time. When integrated with the administration platform, it provides real-time insights into the scheme’s status. It uses live administration data, to ensure accurate and timely information for decision-making.

Real time dashboard

A real time graphical view of the scheme’s funding position with a detailed view of assets and liabilities and more.

Employer client accounting

Mantle supports the FRS 102 accounting standard delivering a current and projected year end position. A prior year view is also available.

Individual member calculations

It’s possible to run individual member calculations for schemes. Once the calculations have been set up in Mantle, the pension actuarial valuation software allows users to refresh the underlying data for further calculations, including transfer values.

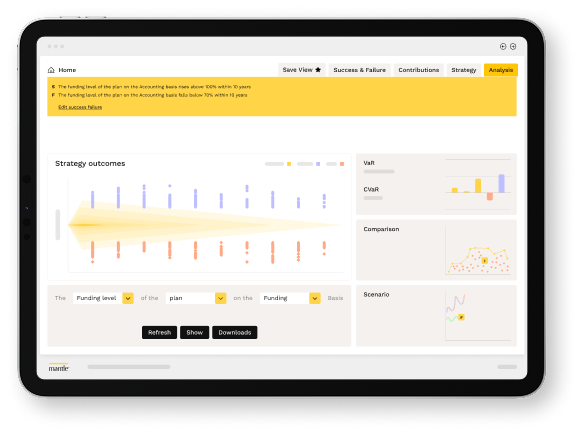

Asset Liability modelling

Mantle makes portfolio testing easier. It reduces over 800 trillion possible strategies to a smaller set of optimised ones. These strategies aim to maximise the chances of meeting the scheme’s funding goals.

Simple success and failure criteria enable the testing of multiple strategies in a measurable way. Value at risk is also available measured on a one year 5% and CVaR basis.

Cashflow generation

Mantle can generate a range of cashflows including 3D. These are calculated against the benefit basis set up in Mantle and the underlying data. They can be exported in a range of formats.

Want to find our more about how Mantle works for Actuarial?

No email required

Industries

Revolutionising pension management with the industry’s most intelligent, all-in-one platform that breaks down silos, eliminates complexity, and transforms how pension teams work, think, and deliver value.

Administrator

Enabling pension scheme administrators to deliver an efficient first-class service.

Actuaries

Empowering actuaries with secure and reliable pension valuation software.

LGPS

Supporting the UK’s largest government pension schemes.

Insurers

Enabling efficiency from pricing to administration.

Annuities

Enabling efficient administration for the full spectrum of retirement products.

Members

Putting the control in the hands of the customer via our phone and web apps.

USA

Efficient Actuarial and Administration software tailored to the American market.

Defined Contribution

Efficient and cost-effective administration for the DC market.